28+ bull call spread calculator

Provide the inputs Provide the Stock Ticker Expiry Date ATM strike price and Spread. Web In this quick video Ill show you how to create a bull spread calculator using Excel.

Bull Call Spread Options Strategy Builder Analyzer Online Optioncreator Com

Select your option strategy type Call Spread or Put Spread Step 2.

. Ad With over 40 years experience in options trading we have a robust set of tools. Free strategy guide reveals how to start trading options on a shoestring budget. Web Bull call spread calculator.

It can also be used by bulls who have a lot of bulls in. The motivation of the strategy is to. Web A bull put spread involves being short a put option and long another put option with the same expiration but with a lower strike.

Clicking on the chart icon on the Bull Call Screener Bull. Web A bull call spread rises in price as the stock price rises and declines as the stock price falls. Web A bull spread involves purchasing an in-the-money call option and selling an out-of-the-money call option with a higher strike price but with the same underlying asset.

Web The bull call spread calculator is a great tool for bulls who are looking for a great way to spread their bull calls. Enter the underlying asset price and risk free rate Step 3. Thus the bull call spread will result in a total debit.

Therefore we will have to pay 113 for the bought strike while we will receive 18 for the sold strike. Web In fact the call ratio back spread has to be executed in the 21 ratio meaning 2 options bought for every one option sold or 4 options bought for every 2 option sold. Ad See the options trade you can make today with just 270.

Web A bull spread involves purchasing an in-the-money ITM call option and selling an out-of-the-money OTM call option with a higher strike price but with the. Tools courses for beginners. You dont need to be an expert to learn to invest like one.

In cases like this your available capital will only have to cover the. Enter the maturity in days of the strategy. Ad Guided by time-tested investment rules.

Web The Bull Call Spread is an options strategy involving the purchase of a Call with a lower strike and the selling of a Call with a higher strike. Web Bull Put Calculator The Bull Put Calculator can be used to chart theoretical profit and loss PL for bull put positions. Web Bull Call Spread Profit Calculator.

This calculator will give you the limit price which you should place your closing. Web Use the Profit Loss Calculator to estimate break-even points evaluate how your strategy might change as expiration approaches and analyze the Option. Web Lets build a Bull Call Spread in Excel using the MarketXLS template.

This calculator will save you time and energy when youre trying to und. Lowest costs for low high frequency options traders. Enter the strikes of your Bull Call Spread and the price paid.

Free investing tools available for self-starters. The short put generates income whereas the.

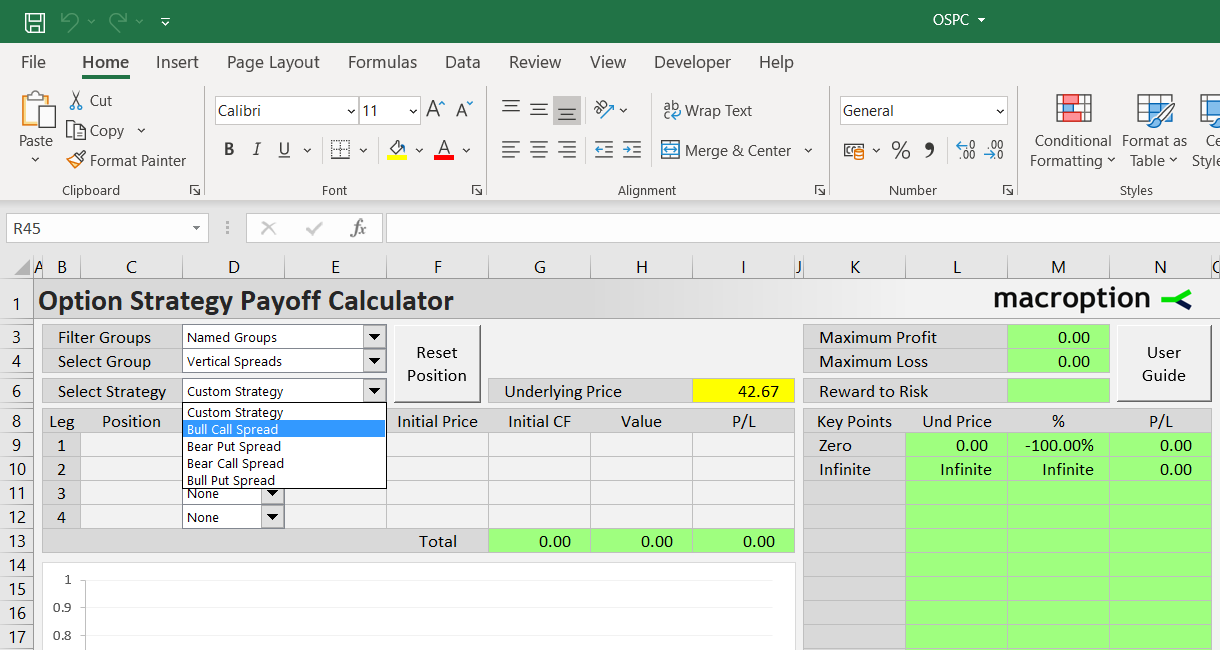

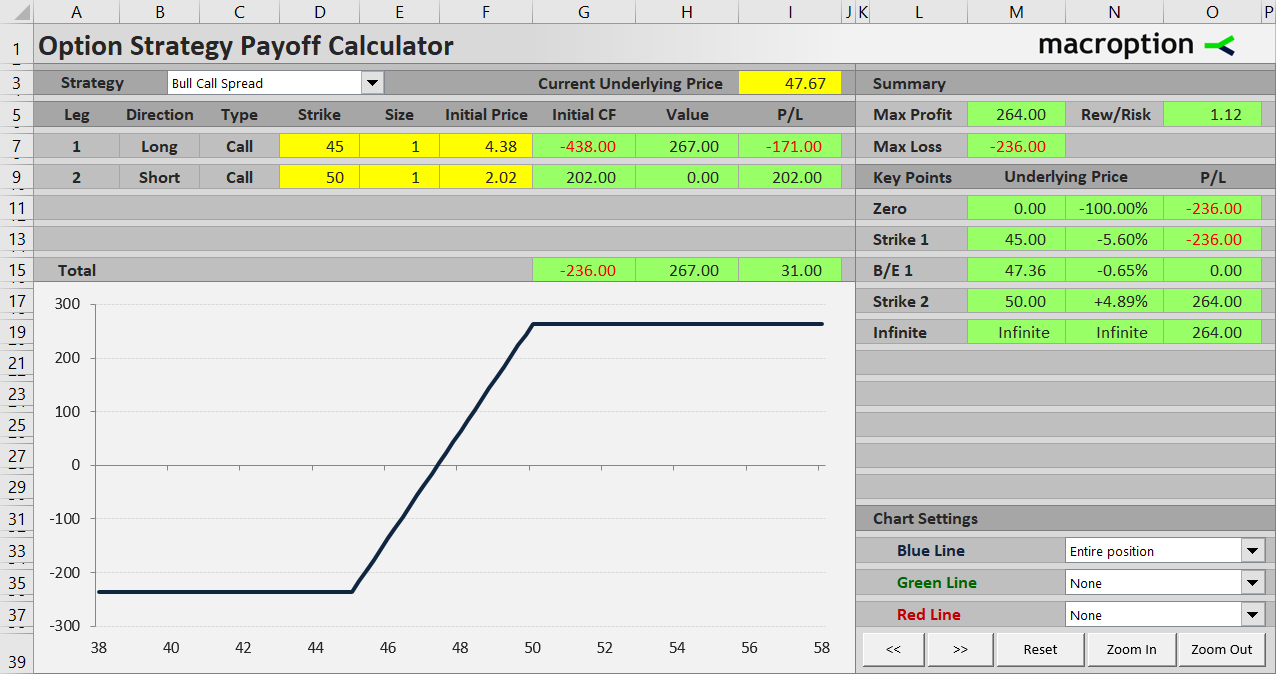

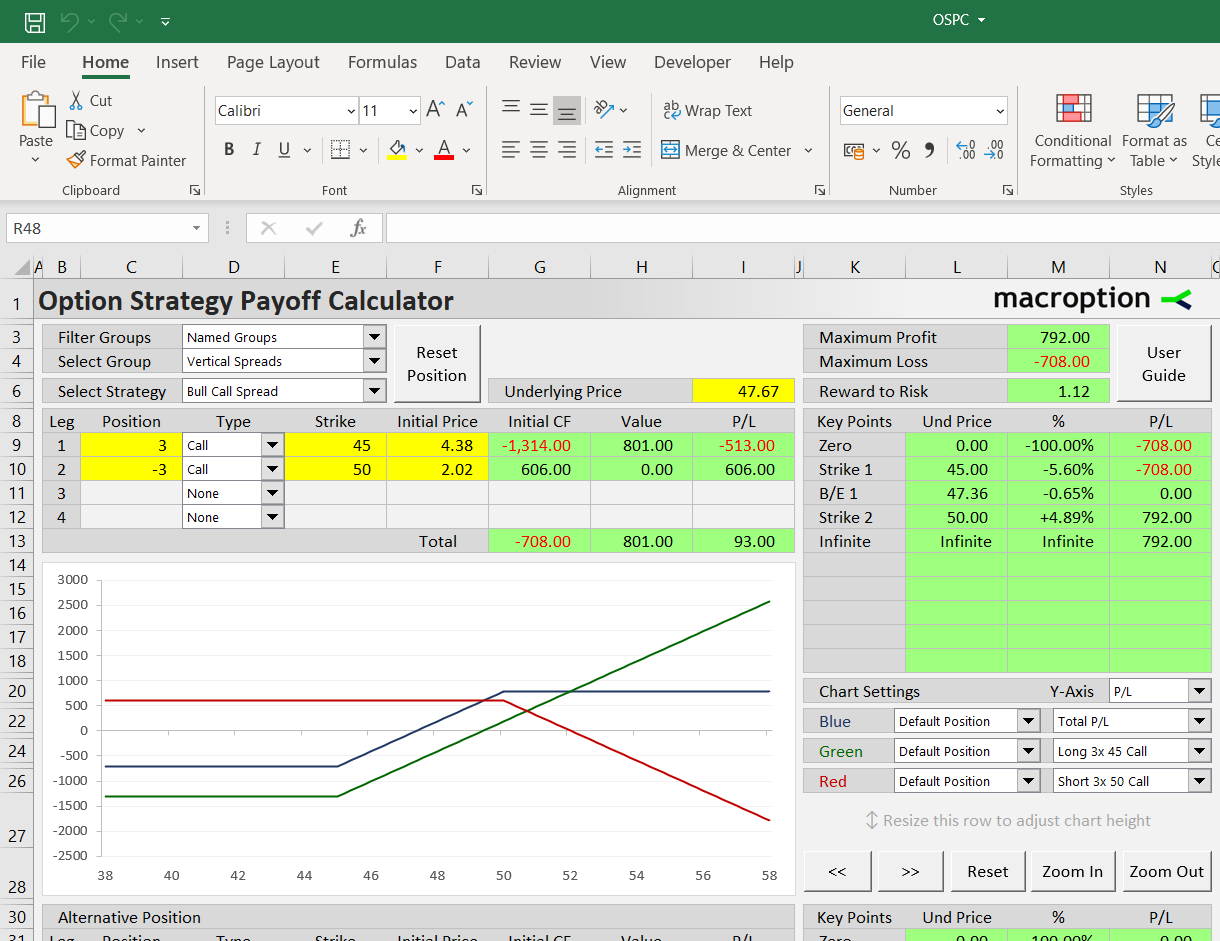

Bull Call Spread Option Strategy Payoff Calculator Macroption

Analytic Combustion Pdf Heat Steam Engine

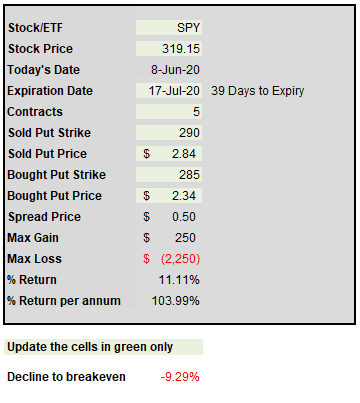

Bull Put Spread Calculator 2020 Update

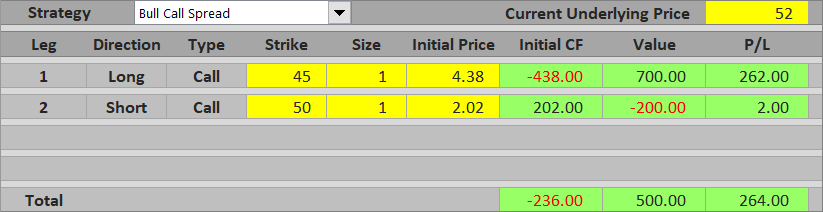

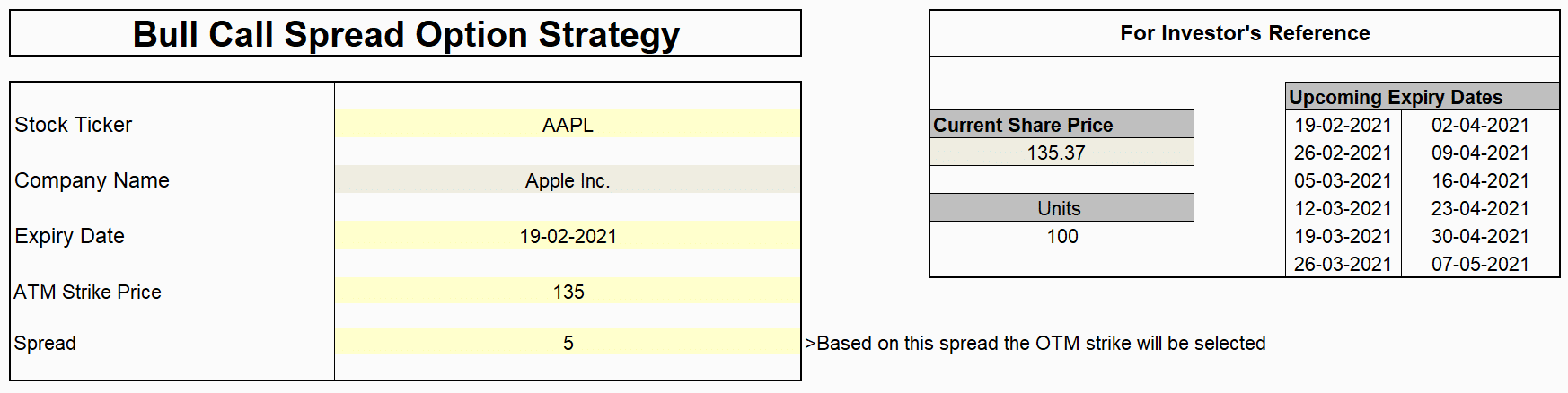

Bull Call Spread Option Strategy Explained With Excel Template Marketxls

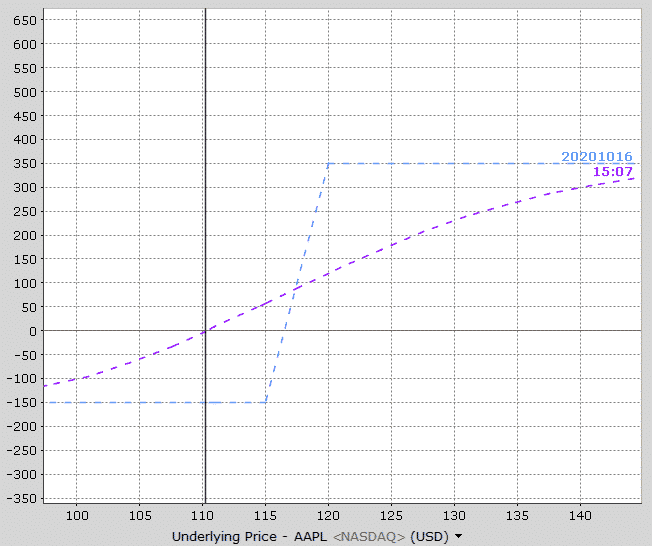

Bull Call Spread Option Payoff Graph

Bull Put Spread Calculator 2020 Update

Bull Call Spread Payoff Break Even And R R Macroption

0wvmggrov4orwm

Bull Put Spread Calculator 2020 Update

Bull Call Spread Payoff Break Even And R R Macroption

I Am Saving Around 50k Per Month Should I Buy A Flat On Loan Or Should I Invest In Equity Or Mutual Fund Quora

Using The Free Trade Calculator To Profit On Call And Put Spreads Option Party

Bull Call Spread Option Strategy Explained With Excel Template Marketxls

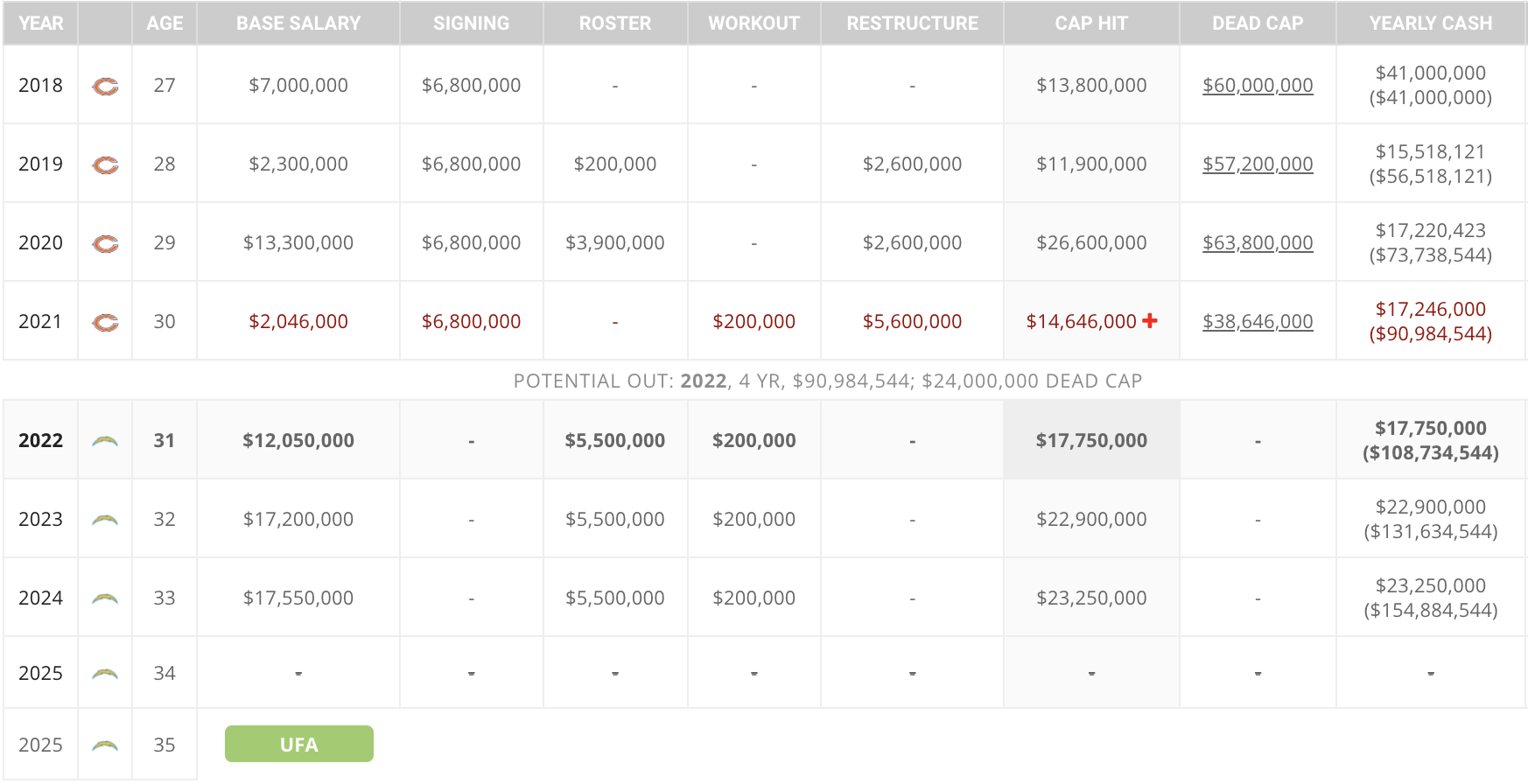

Spotrac Research News Reports

Options Spread Calculator

How To Draw Bull Call Spread Payoff Using Excel Youtube

Bull Call Spread Option Strategy Payoff Calculator Macroption